Posted 11-28-2014 1:01 pm by

Since the financial crisis of 2008, the United States Federal Reserve has increased our base money supply by over $3 trillion. What are the impacts of this for those looking to sell their business?

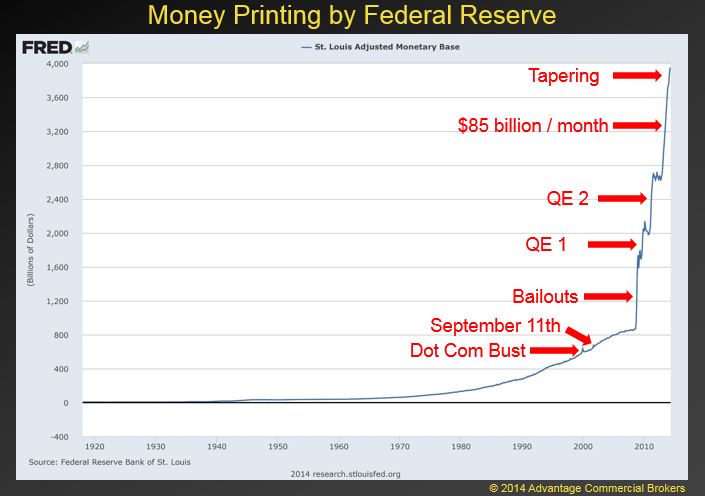

The graph here is data directly from the Federal Reserve, showing the growth of our base money supply since the creation of the Federal Reserve on Christmas Eve, 1919. It has taken the United States more than 200 years to expand our money supply to around $875 billion in 2008. Since the great recession of 2008, the Fed has more than quadrupled our money supply to more than $3.8 trillion.

To put things in perspective, the graph above shows the relative amounts of money printing among the various events. The tiny spike is the dot com bust, followed by an even tinier spike for September 11th. Since 2008, however, the corporate bailouts started an unprecedented trend of money printing, followed by quantitative easing 1, or QE 1, even though it was the second wave of money printing. Then came QE 2, followed by a continuous money printing of $85 billion per month. While the $85 billion per month has been tapered, one cannot deny the extraordinary, perhaps scary, growth of our nation’s money supply.

What are the impacts of the Federal Reserve’s actions for those looking to sell their businesses? It is worth remembering that the Fed has basically two tools in its toolbox: adjust the interest rate, and print money. In this case, the Fed has used its two tools to the max - interest rates are at practically zero, and our base money supply had been quadrupled in the last seven years.

With nominal interest rates so low and real interest rates being negative when inflation is taken into account, savers are punished. Instead of keeping money in the bank, people are forced to invest the money somehow in order to beat the meager interest rates of savings accounts, certificates of deposits (CDs), and money market accounts. What many have done is to gamble their savings in the stock market, driving the U.S. stock market to record highs. Just when one thinks the Dow can’t go any higher, it starts a rally and makes another new high.

Smart investors, however, know that all parties come to an end eventually. Instead of holding paper assets, smart investors are shifting to tangible assets such as real estate, businesses, oil wells, productive farmland, gold, and silver. Astute investors know that the debasing of the U.S. Dollar will eventually lead to price inflation, and that paper money, after all, is made of just paper and backed by nothing other than the government’s promise that one’s paper money will retain its value.

While the majority of the American public are still celebrating the new highs the Dow keeps making, smart money is quietly accumulating tangible assets. In the Seattle metropolitan area, more and more investors are realizing that they do not want to keep their wealth in the bank due to the low interest rates, and that the stock market is becoming dangerously overvalued. Buying a business offers a higher cash-on-cash return, internal rate of return, and net present value than most other tangible assets do. Astute buyers know that a well purchased business will not only retain its value, but also increase in cash flow if they purchase a “recession proof” business or one that thrives during recessions.

In conclusion, an increasing number of astute investors are interested in buying solid businesses in light of the Federal Reserve’s actions. For business sellers looking to cash out and move onto the next stage of their lives, now may be a good time to start the process.

Aaron Muller has sold over 120 companies and facilitated over 40 SBA loans for his clients. Contact Aaron at (425) 766-3940 to inquire about selling your business.